Listen to the article

The tokenized commodities market has risen 53% in less than six weeks to over $6.1 billion, making it the fastest-growing vertical in the real-world asset tokenization market as more gold moves onchain.

The tokenized commodities market was valued at just over $4 billion at the start of the year, meaning around $2 billion has been added to the market’s value since Jan. 1, according to data from crypto analytics platform Token Terminal.

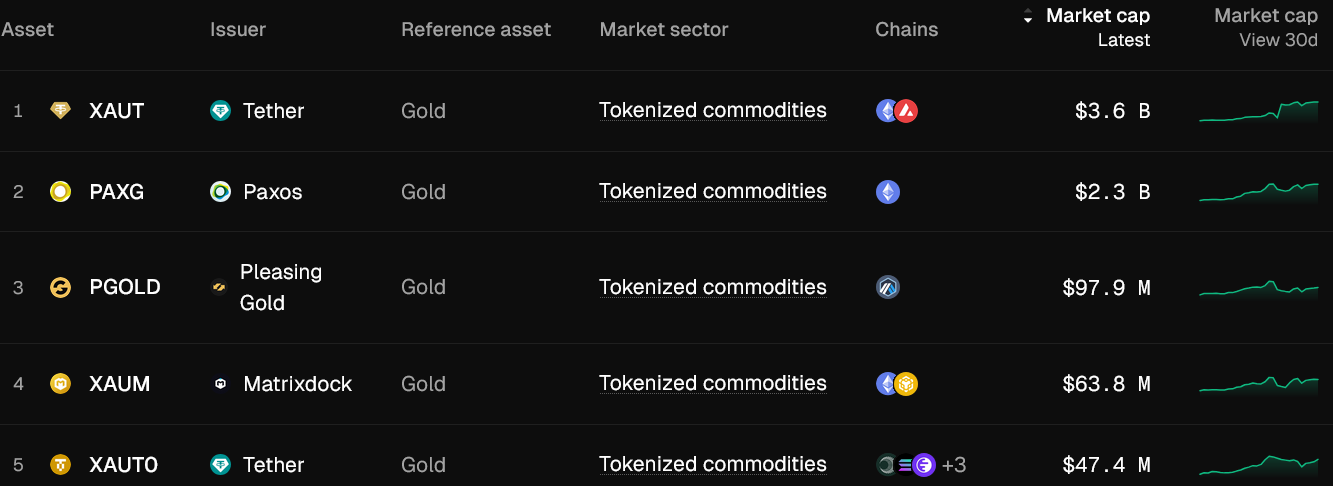

Data shows the tokenized commodities market is dominated by gold products.

Stablecoin issuer Tether’s gold-backed token, Tether Gold (XAUt), has been the biggest contributor to the rise, with its market cap increasing 51.6% in the past month to $3.6 billion, while the Paxos-listed PAX Gold (PAXG) has increased 33.2% to $2.3 billion over the same timeframe.

Tokenized commodities have now risen 360% year-on-year, with the increase since the start of 2026 outpacing growth in the tokenized stocks and tokenized funds markets at 42% and 3.6%, respectively.

It also puts the tokenized commodities market at just over one-third the size of the $17.2 billion tokenized funds market. It’s also much larger than tokenized stocks, which are valued at $538 million.

Tether expanded its tokenized commodities strategy on Thursday by acquiring a $150 million stake in precious metals platform Gold.com, in an effort to broaden access to tokenized gold.

Tether said its XAUt token would be integrated into Gold.com’s platform and that it is exploring options to allow customers to purchase physical gold with USDt (USDT) stablecoin.

Gold picks up the pace as Bitcoin stuck below $70,000

The rise in tokenized gold comes as gold’s spot price rallied more than 80% over the past year to set a new all-time high of $5,600 on Jan. 29.

A minor pullback saw gold retrace to the $4,700 mark earlier this month, but it has since risen back up to $5,050 at the time of writing.

Related: Do Super Bowl ads predict a bubble? Dot-coms, crypto and now AI

Meanwhile, Bitcoin (BTC) and the crypto market have been in a slump since Oct. 10, when a crypto market crash triggered $19 billion in liquidations.

Bitcoin fell 52.4% from its early October high of $126,080 to about $60,000 on Friday but has since rebounded to $69,050, CoinGecko data shows.

Bitcoin’s fall amid a rise in traditional safe-haven assets has led some industry commentators, like Strike CEO Jack Mallers, to speculate that Bitcoin is still treated like a software stock despite having hard money characteristics.

Crypto asset manager Grayscale similarly said Bitcoin’s long-standing narrative as “digital gold” has been put to the test, stating that its recent price action increasingly resembles that of a high-risk growth asset rather than a traditional safe-haven.

Magazine: Big questions: Should you sell your Bitcoin for nickels for a 43% profit?

Read the full article here

Fact Checker

Verify the accuracy of this article using AI-powered analysis and real-time sources.