Listen to the article

Bitcoin (BTC) sellers resumed their activity on Thursday as the Bitcoin price turned away from its intraday high of $68,300. Analysts said that Bitcoin remained in capitulation, which could push the price lower, potentially reaching a bottom during the last quarter of 2026.

Key takeaways:

-

Multiple onchain indicators suggest Bitcoin is in deep capitulation as downside risks remain.

-

Long-term holder net-position change shows extreme distribution, mirroring past corrections that preceded further downside before bottoms.

-

Analysts forecast BTC price to hit a bottom in Q4/2026 based on various technical and onchain metrics.

Bitcoin’s capitulation persists

Bitcoin’s 46% drawdown from its all-time high of $126,000 has left a significant portion of holders underwater, and data shows they are now reducing their exposure.

Glassnode’s long-term holder (LTH) net-position change shows that Bitcoin held by these investors over 30 days decreased by 245,000 BTC on Feb. 6, marking a cycle-relative extreme in daily distribution. Since then, this investor cohort has been reducing its exposure by an average of 170,000 BTC, as shown in the chart below.

Related: Binance teases Bitcoin bullish ‘shift’ as crypto sentiment hits record low

Similar spikes in LTH net position change appeared during the corrective phases in 2019 and mid-2021, leading to BTC price consolidating before extended downtrends.

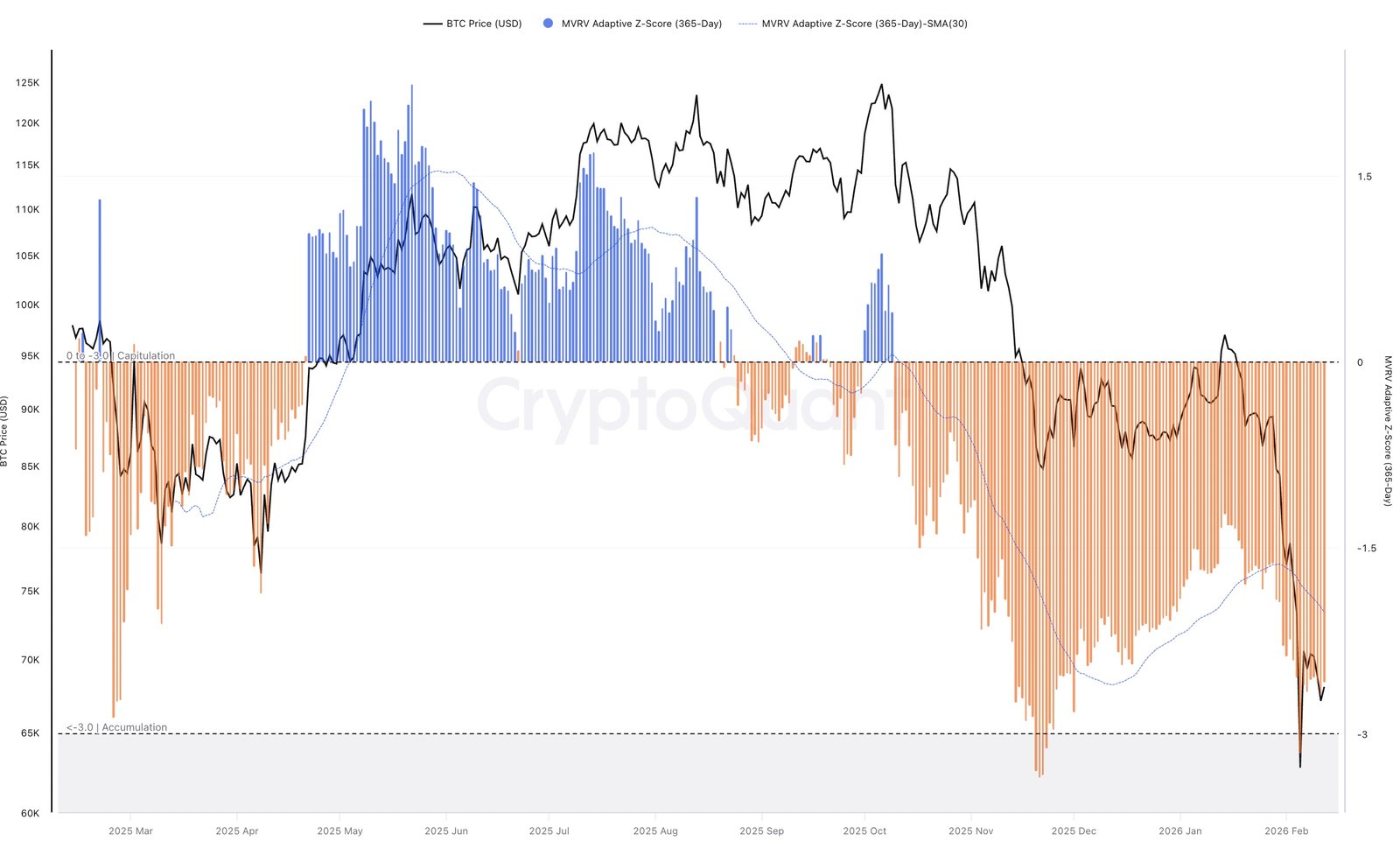

CryptoQuant data shows that Bitcoin’s MVRV Adaptive Z-Score (365-Day Window) has fallen to -2.66, reinforcing the intensity of the sell-side pressure.

“The current Z-Score reading of -2.66 proves that Bitcoin remains persistently in the capitulation zone,” CryptoQuant contributor GugaOnChain said in a Thursday Quicktake post, adding:

“The indicator suggests that we are approaching the historical accumulation phase.”

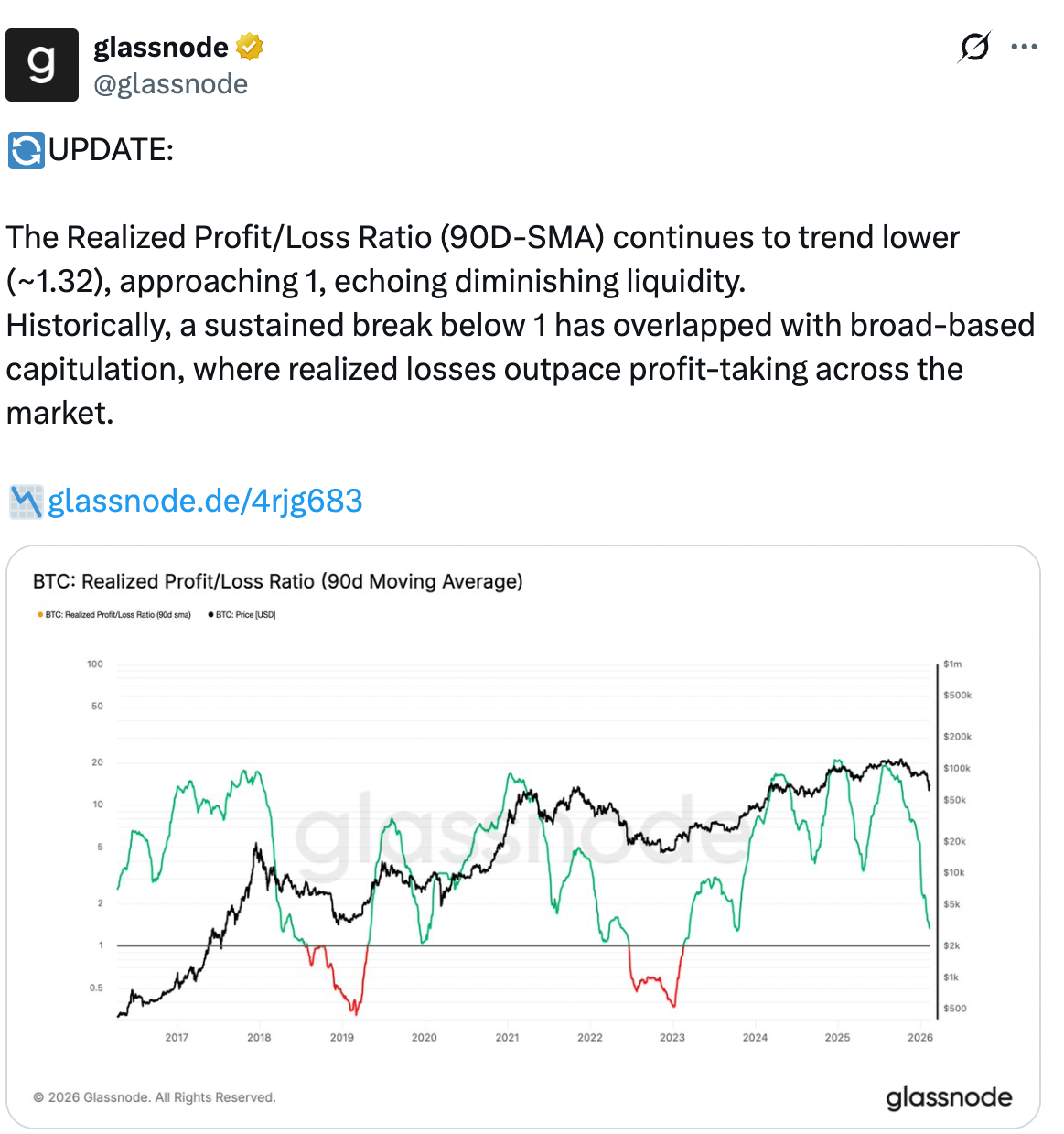

Bitcoin’s Realized Profit/Loss Ratio is about to break below 1, levels that have historically aligned with “broad-based capitulation, where realized losses outpace profit-taking across the market,” Glassnode said.

Analysts say Bitcoin will bottom out toward the end of 2026

According to multiple analyses, Bitcoin could extend its downtrend, possibly reaching as low as $40,000 to $50,000 during the last quarter of the year.

The “final capitulation on $BTC is still ahead,” Crypto analyst Tony Research said in a recent post on X, adding:

“My take is, $BTC will bottom at $40K–50K, most likely forming between mid-September and late November 2026.”

Fellow analyst Titan of Crypto said that previous bear cycles in 2018 and 2022 printed their lows 12 months after the bull market top.

Bitcoin’s current all-time high of $126,000 was reached on Oct. 2, 2025.

“If this cycle follows the same rhythm, that puts the low around October,” the analyst added.

On-Chain College shared a chart showing that Bitcoin’s Net Realized Loss levels hit extreme levels at $13.6 billion on Feb. 7, levels last seen during the 2022 bear market.

“The 2022 loss peak occurred 5 months before the actual bear market bottom was printed,” the analyst said, suggesting that BTC could form a bottom in July 2026.

As Cointelegraph reported, many analysts expect 2026 to be a bear market year, and various forecasts predict the BTC price dropping to as low as $40,000.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Read the full article here

Fact Checker

Verify the accuracy of this article using AI-powered analysis and real-time sources.