Listen to the article

Bitcoin (BTC) is approaching “undervalued” territory for the first time in three years as a classic indicator nears its inflection point.

Key points:

-

Bitcoin has not been so “undervalued” versus its market cap since March 2023, research shows.

-

The MVRV ratio is approaching its key breakeven level for the first time in over three years.

-

MVRV analysis sees Bitcoin in the process of reversing its downtrend.

Bitcoin value metric echoes $20,000 price

Research from onchain analytics platform CryptoQuant released on Friday reveals key developments on Bitcoin’s market value to realized value (MVRV) ratio metric.

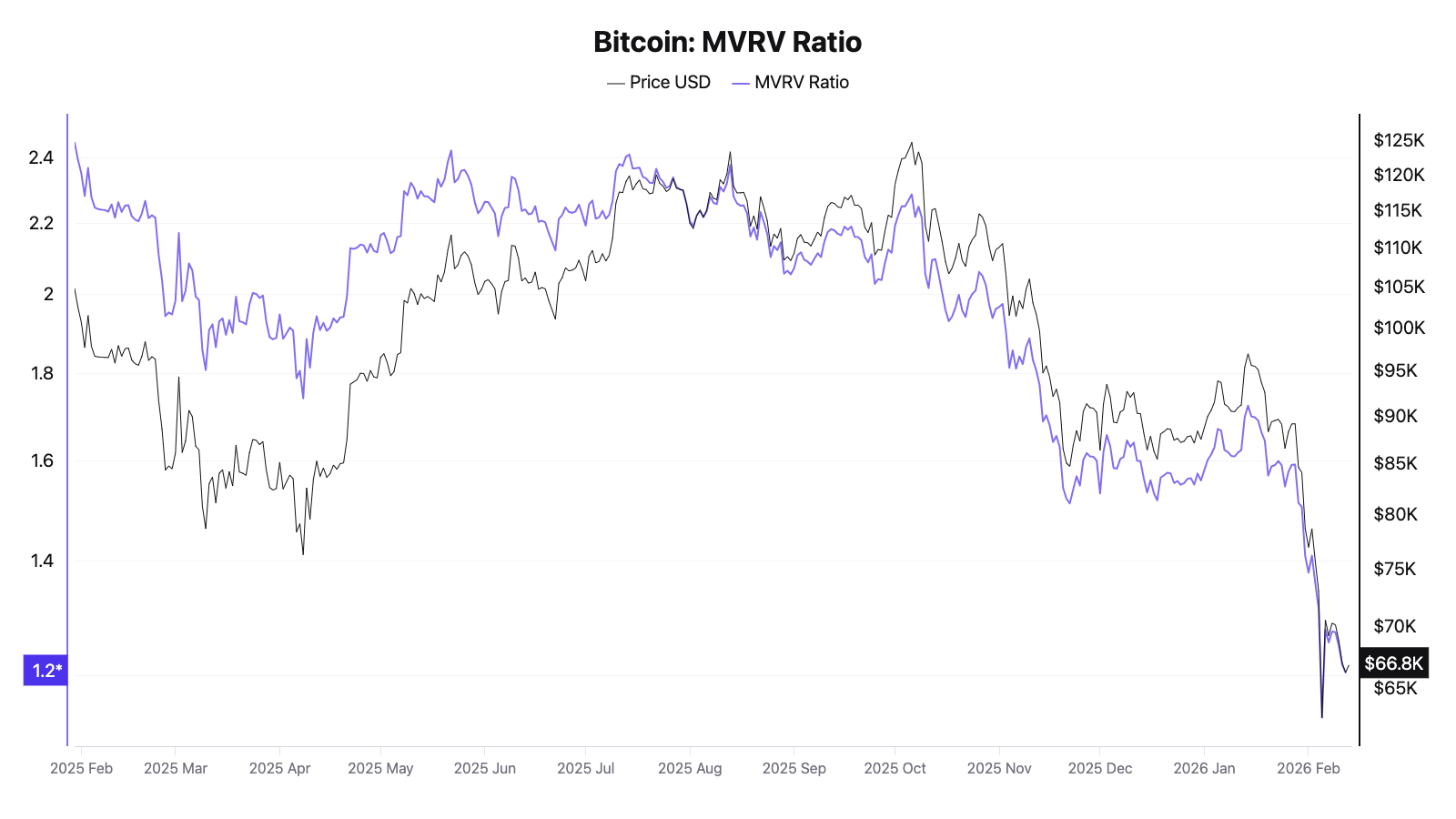

A classic BTC price gauge, the MVRV ratio compares Bitcoin’s market cap to the price at which the supply last moved, also known as its “realized cap.”

Values below 1 imply that the supply is undervalued at current prices. Last week, as BTC/USD dropped below $60,000, MVRV hit 1.13 — its lowest reading since March 2023, when it traded at just $20,000.

“Following its all-time high in October 2025, Bitcoin has been in a downtrend for approximately four months and is now approaching what can be considered an undervalued zone,” CryptoQuant contributor Crypto Dan commented.

“Generally, when the MVRV ratio falls below 1, Bitcoin is regarded as undervalued. At present, the indicator stands at around 1.1, suggesting that price levels are nearing the undervaluation range.”

MVRV last registered below 1 at the start of 2023. At the time of Bitcoin’s latest all-time high last October, the ratio peaked at 2.28.

Crypto Dan questioned the validity of Bitcoin’s 52% drop from all-time highs. Neither the top nor the bottom, he argued, was characteristic of typical MVRV behavior.

“However, unlike previous cycles, Bitcoin did not experience a sharp rise into a clearly overvalued zone during the recent bull cycle,” the research post continued.

“This distinction is important to recognize. As a result, the current decline may also differ from past market bottoms, and it appears necessary to respond with this possibility in mind.”

Bitcoin price bottom “being forged right now”

In January, Cointelegraph reported on early signs that BTC price action may be preparing a trend reversal.

Related: Binance teases Bitcoin bullish ‘shift’ as crypto sentiment hits record low

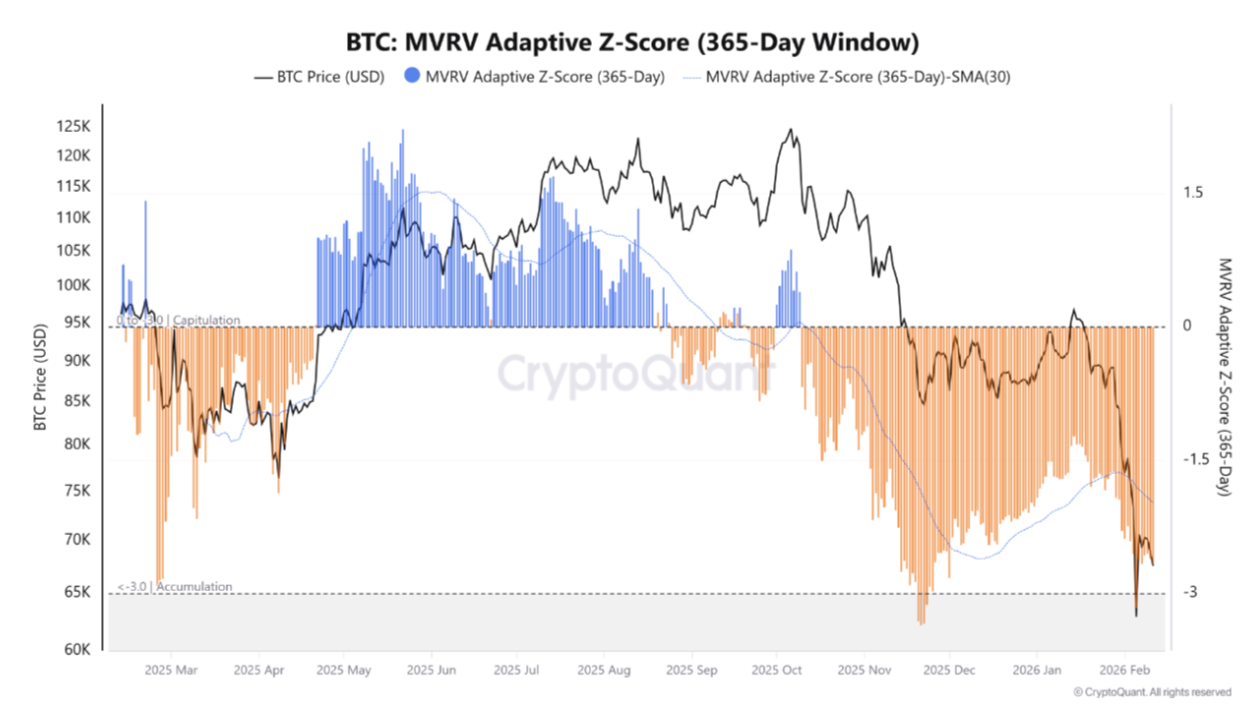

On two-year rolling time frames, the Z-score of the MVRV ratio, which divides its readings by the standard deviation of market cap, recently fell to historic lows.

“The current Z-Score of $BTC is lower than during the bear market bottom in 2015, 2018, COVID crash 2020 and 2022,” crypto trader, analyst and entrepreneur Michaël van de Poppe observed at the time.

This week, CryptoQuant contributor GugaOnChain used another Z-score iteration to show that BTC/USD was in a “capitulation zone.”

“The indicator suggests that we are approaching the historical accumulation phase,” he wrote in an accompanying post.

“The statistical deviation of the Z-Score screams opportunity, signaling that the bottom of this downtrend is being forged right now.”

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Read the full article here

Fact Checker

Verify the accuracy of this article using AI-powered analysis and real-time sources.