Listen to the article

Key points:

-

Bitcoin slips under $104,000 amid doubts over BTC price support.

-

Price targets now include the CME futures gap at $92,000.

-

Short-term holders head deep into the red, sitting on growing unrealized losses.

Bitcoin (BTC) faced further losses Tuesday as traders prepared for sub-$100,000 BTC price levels.

Bitcoin price in “freefall” as $104,000 slips

Data from Cointelegraph Markets Pro and TradingView tracked new lows of $103,732 on Bitstamp, with the price down over 2% Tuesday.

Early weakness persisted during the Asia trading session as market participants increasingly suggested that the $100,000 support level would fail.

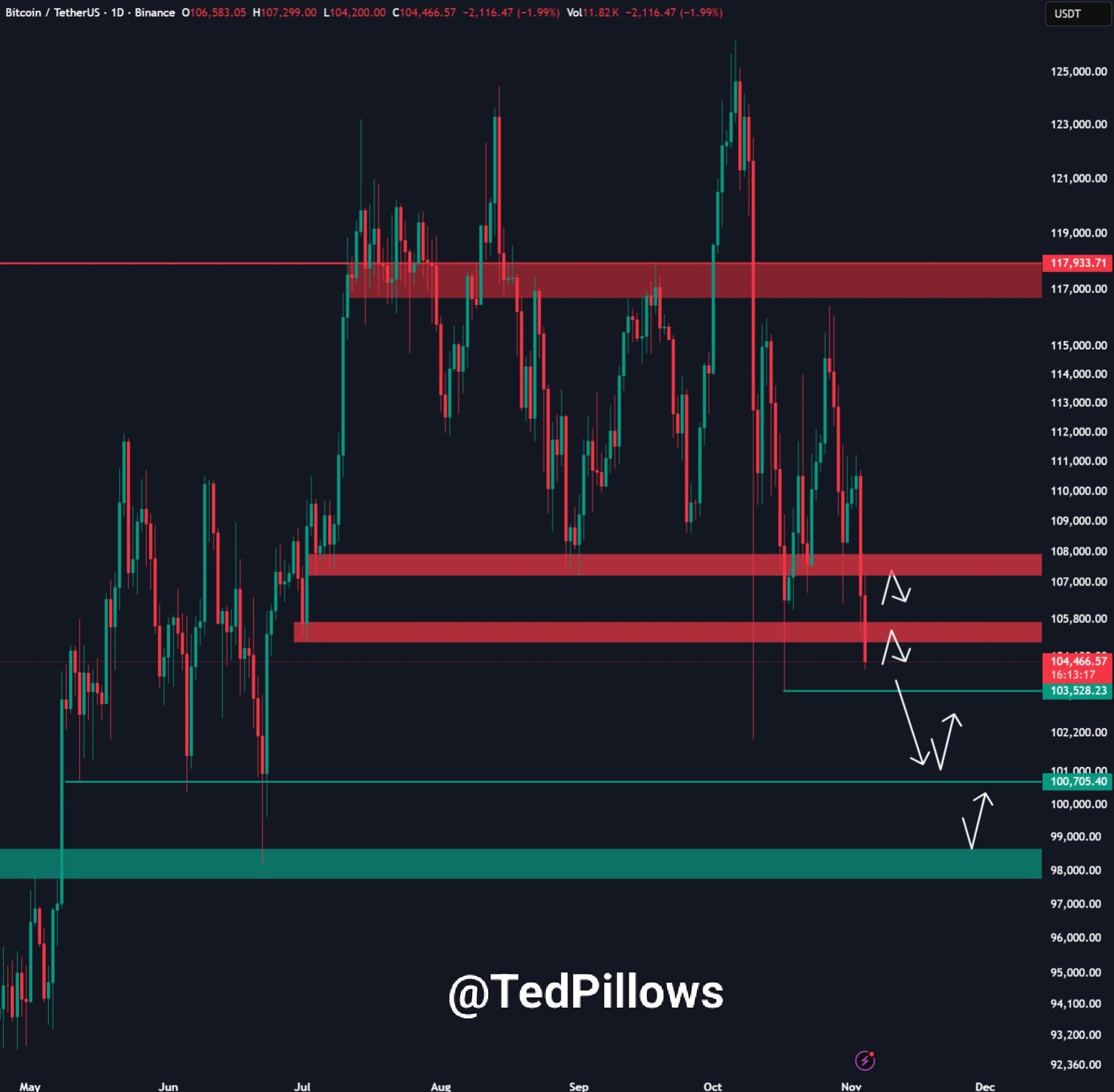

“$BTC is in absolute free fall right now,” crypto investor and entrepreneur Ted Pillows reacted on X.

“There’s no strong support until the $100,000 level, which means it’ll most likely get retested.”

Pillows eyed an unfilled weekend “gap” in CME Group’s Bitcoin Futures market at around $92,000, just below the 2025 yearly open.

“If Bitcoin loses the $100,000 zone, expect a correction towards the $92,000 level, which has a CME gap,” he added.

Trader Daan Crypto Trades warned that BTC/USD had lost its “main support” from recent weeks.

“Now nearing the bottom of the range where price made its initial higher low after the bounce post 10/10 liquidation event,” an X post read, referring to the Oct. 10 crypto market crash.

Daan Crypto Trades noted that, in addition to “massive” selling by Bitcoin whales, US stocks had become less bullish, while US dollar strength was rising, three potential headwinds for crypto.

“All in all not a great recipe for the time being,” he concluded.

Derivatives trader Ardi was among those eyeing a fill of the Oct. 10 candle wick, which on Binance had reached $102,000.

$BTC 10/10 liquidation wick now getting filled.

Back into the $103K range. pic.twitter.com/Gr37PuK0h5

— Ardi (@ArdiNSC) November 4, 2025

This level features confluence with Bitcoin’s 50-week exponential moving average (EMA) — a level untouched for seven months.

Unrealized losses spark “capitulation”

Price pressure in turn led to renewed stress on recent Bitcoin buyers, who were now underwater on their holdings.

Related: Retail investors’ retreat’ to $98.5K: 5 things to know in Bitcoin this week

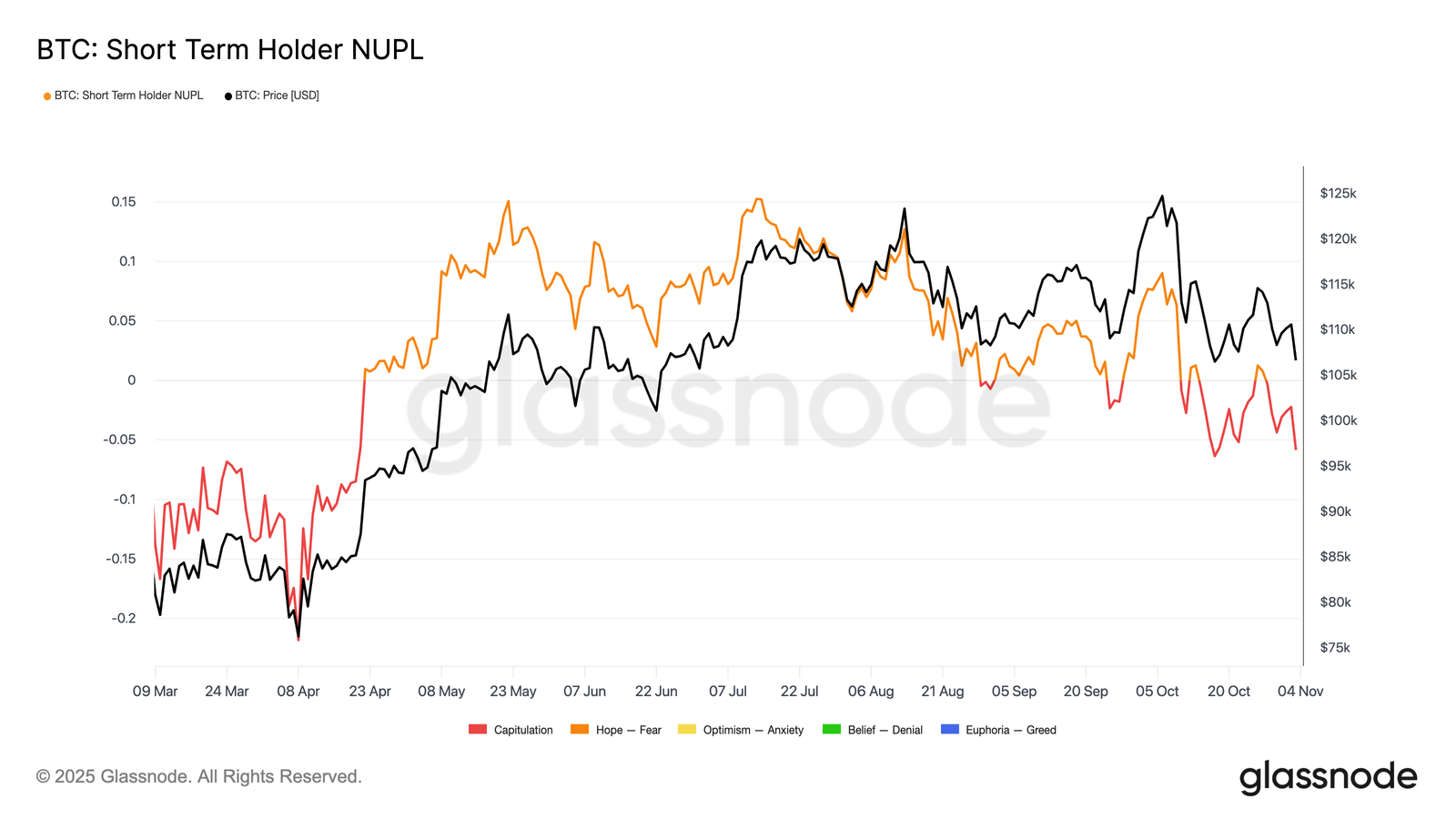

Data from onchain analytics platform Glassnode showed the Net Unrealized Profit/Loss (NUPL) indicator for short-term holders (STHs) returning to “capitulation” territory.

NUPL looks at the profitability of onchain transactions involving entities hodling for up to 155 days. At the time of writing, it measured -0.058, on the way toward its lowest levels since April.

“Historically, such periods of STH stress and capitulation have marked attractive accumulation opportunities for patient investors,” Glassnode commented on X Monday.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

Read the full article here

Fact Checker

Verify the accuracy of this article using AI-powered analysis and real-time sources.