In brief

- Publicly traded Bitcoin miner MARA said that it had generated $252 million in revenue, a 92% year-over-year increase

- The firm is looking to expand beyond Bitcoin mining, embracing a role as a digital infrastructure firm that also helps power AI.

- Shares of MARA have fallen around 6% as Bitcoin briefly slipped below $100K.

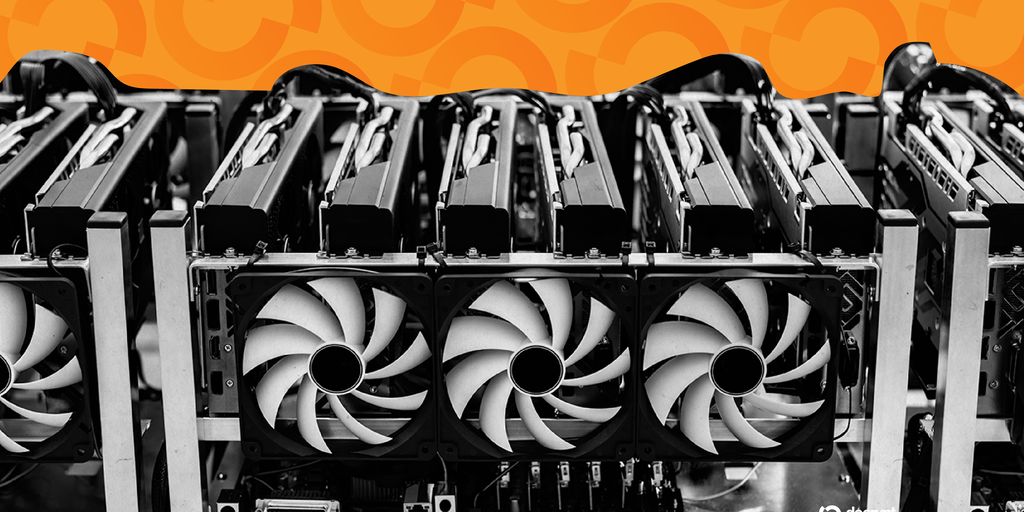

Publicly traded Bitcoin miner, MARA, recorded the firm’s highest ever quarterly revenue in Q3, generating $252 million, a 92% year-over-year increase.

The firm also generated income of $123 million or $0.27 per share compared to a loss of $124 million at this time last year, while improving its energized hashrate and its Bitcoin mining fleet efficiency. Shares of MARA were down approximately 5.8% today, changing hands at $16.96 as crypto and other asset markets fell.

But in an earnings call, the company highlighted its efforts to expand services for AI computing. .

“This quarter we continued to evolve MARA from a pure play Bitcoin miner into a vertically integrated digital infrastructure company. One that converts energy into both value and intelligence,” MARA CEO Fred Thiel said on its Q3 earnings call.

“At the heart of our strategy is a simple belief—electrons are the new oil. Energy is becoming the defining resource of the digital economy, powering everything from Bitcoin mining to artificial intelligence.”

Long-term, Thiel said the firm is focused on integrating the energy pathways of Bitcoin and AI into a single platform.

“Bitcoin mining monetizes underutilized energy and stabilizes grids, while AI inference transforms that same energy into intelligence and productivity,” he added.

As part of that initiative, MARA deployed its first AI inference racks at its Granbury, Texas site after the quarter closed.

Additionally, the firm announced a partnership with MPLX which will allow it to tap into low-cost natural gas supply for planned power facilities and data centers in West Texas.

Other Bitcoin miners have been leaning into connections with artificial intelligence as well. On Monday, former BTC miner turned AI cloud computing firm, IREN, inked a $9.7 billion deal with Microsoft.

Meanwhile, Bitcoin miner Cipher Mining struck a similar deal valued at $5.5 billion with Amazon to deliver power and space for AI workloads.

The firm holds around 53,250 BTC valued at $5.3 billion, making it the second largest publicly traded Bitcoin treasury. It recently added 400 BTC after the $19 billion record-breaking crypto liquidations sent the price lower during October.

Bitcoin fell 6% in the last 24 hours to trade at about $100,500, according to CoinGecko data. BTC fell under $100,000 on some exchanges earlier in the day for the first time in six months. Its price is down about 20% from its record high, set in early October.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.