Listen to the article

Bitcoin (BTC) market sentiment has begun to recover as exchange traders reconsider selling.

Key points:

-

Bitcoin taker flow finally sees positive values after a month of seller dominance.

-

“Aggressive” sell pressure is fading at current price levels, analysis says.

-

The Crypto Fear & Greed Index hits record lows despite BTC price stabilization.

Bitcoin exchanges eye “early signs of stabilization”

New findings from onchain analytics platform CryptoQuant released on Thursday show net taker flow flipping positive for the first time in a month.

“Bitcoin market sentiment is showing early signs of stabilization, and Binance’s 7-day Net Taker Flow reflects that shift when viewed in proper macro context,” contributor Crazzyblockk summarized in one of its “Quicktake” blog posts.

The metric, expressed as the difference between market buy and market sell orders, has been deep in negative territory since mid-January.

“After reaching nearly -$4.9B in cumulative net selling in early February, Binance’s 7-day taker flow has steadily recovered and flipped positive to around +$0.32B,” Crazzyblockk continued.

“The sentiment ratio has moved from roughly -3% back into positive territory, signaling a clear decline in sell-side aggression.”

The post added that the phenomenon was visible across major exchanges, with Binance nonetheless showing a “stronger shift in net buying pressure than peers.”

The change comes as BTC price action attempts to stabilize around 20% above recent 15-month lows near $59,000.

As Cointelegraph reported, however, market participants see a risk of stagnation below $69,000 — a key resistance level ever since the top of the 2021 Bitcoin bull market.

Crypto sees more “extreme greed” than ever

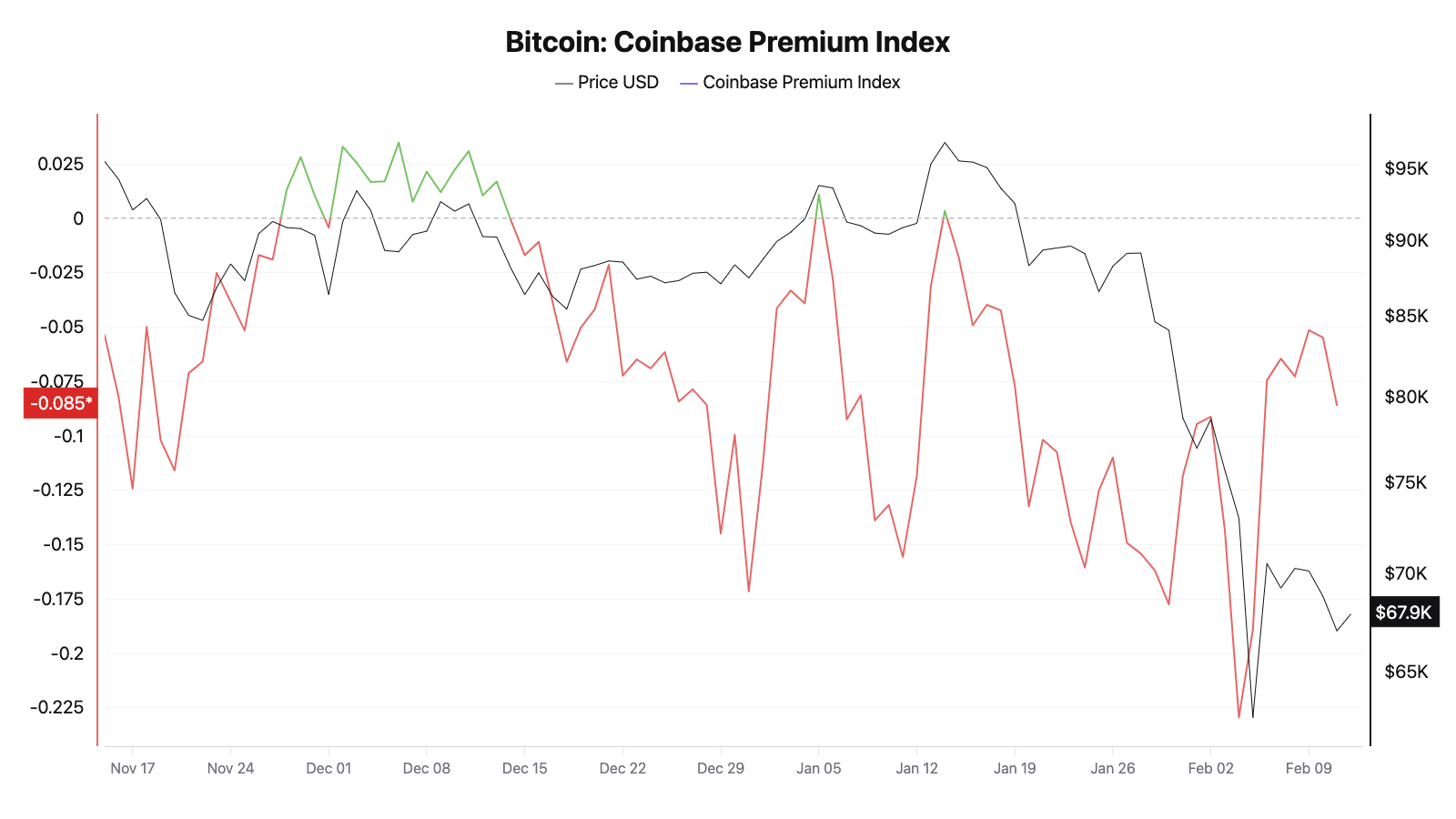

The split between exchanges, meanwhile, continues to be visible via the Coinbase Premium Index.

Related: BTC traders wait for $50K bottom: Five things to know in Bitcoin this week

This indicator measures the difference in price between Coinbase’s BTC/USD and Binance’s BTC/USDT pairs, and has also been almost entirely “red” since the middle of last month.

A negative Premium implies lower US spot demand compared to Asia, and the latest CryptoQuant data confirms that the status quo remains despite the modest BTC price bounce.

Commenting, trading company QCP Capital described the Premium reduction, implying a “moderation in U.S.-led spot selling pressure.”

QCP tempered enthusiasm as it referenced “extreme fear” signals from crypto market sentiment gauge, the Crypto Fear & Greed Index.

“That said, sentiment remains fragile, with the Crypto Fear & Greed Index still deep in extreme fear territory at 9, which is less ‘all clear’ and more ‘thin ice that happens to be holding,’ it wrote in its latest “Asia Color” market update on Wednesday.

The Index has since dropped to just 5/100, a score which ranks among its lowest ever recorded.

🚨 TODAY: Crypto Fear & Greed Index plunges to 5 Extreme Fear, the lowest level on record. pic.twitter.com/30srOiR5Ak

— Cointelegraph (@Cointelegraph) February 12, 2026

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Read the full article here

Fact Checker

Verify the accuracy of this article using AI-powered analysis and real-time sources.