Listen to the article

Bitcoin round tripped gains after a spike to $70,000 as liquidity traps began to characterize BTC price action on the US bank holiday.

Bitcoin (BTC) took out long and short positions during Monday as low-volume trading sparked short-term volatility.

Key points:

-

Bitcoin sees low-time frame manipulation clear both longs and shorts on the US bank holiday.

-

BTC price action offers “breakouts and shakeouts” while staying in a narrow range.

-

2022 bear market comparisons continue, now focused on weekly RSI.

BTC price liquidity squeezes shake out traders

Data from TradingView captured sharp moves within a narrow BTC price range on the US bank holiday which topped out at $70,000.

With Wall Street closed, thinner order books overall made it easier for large-volume entities to influence short-term price action. This resulted in multiple “squeezes” that impacted both longs and shorts.

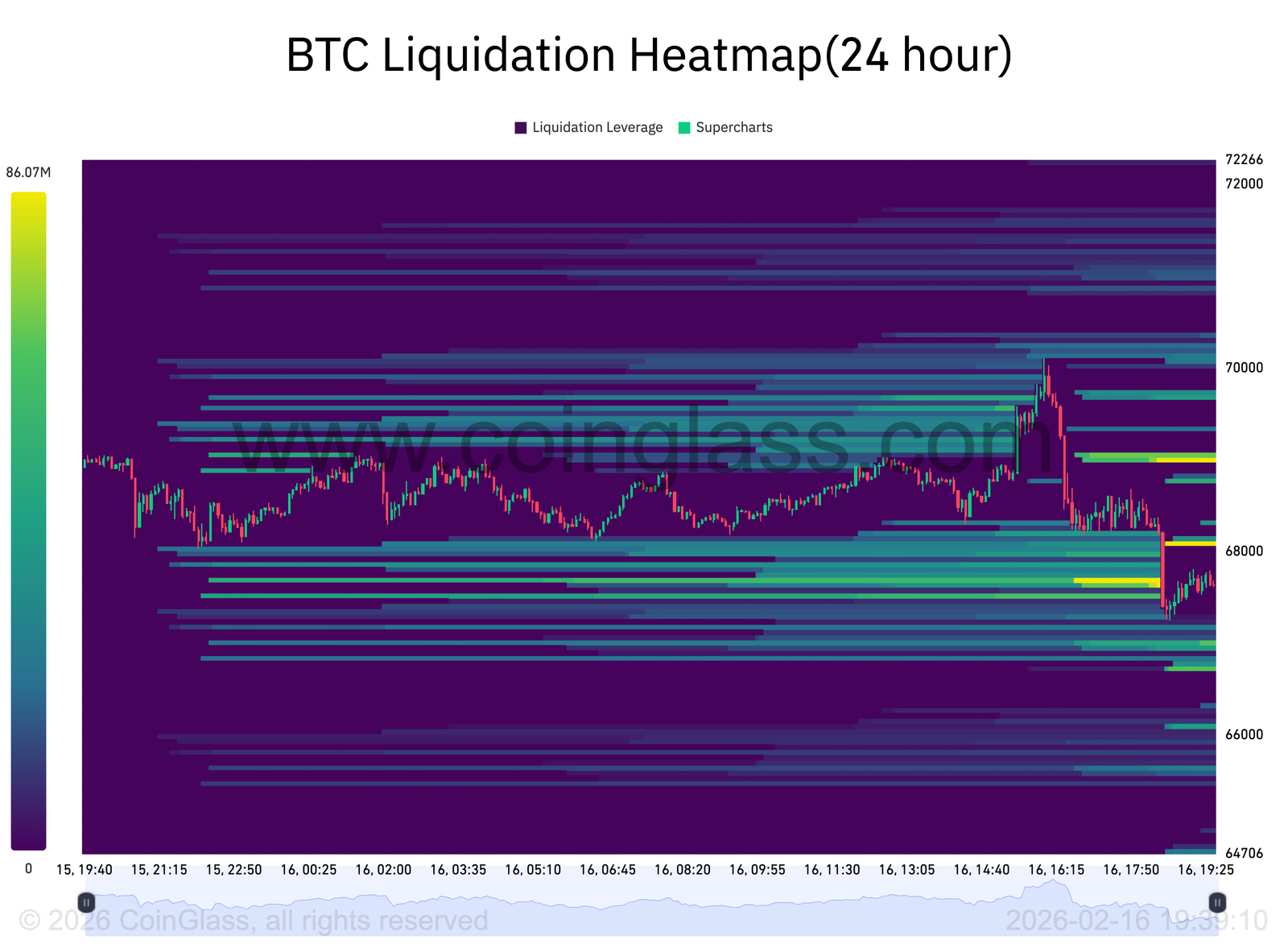

Data from monitoring resource CoinGlass showed $120 million in crypto liquidations for the four hours to the time of writing.

Blocks of bids and asks were cleared on the day, with new “walls” placed immediately above price as it fell, adding to downward pressure.

“Volatility is much higher which is something that we also see in pretty much all other markets lately. Definitely not a calm period for markets around the world,” trader Daan Crypto Trades commented in a post on X.

Trading resource Material Indicators described the latest BTC price performance as “breakouts and shakeouts.”

An accompanying chart monitored both liquidity and whale activity on Binance’s BTC/USDT pair.

Trader CW nonetheless observed that buying pressure was more robust than on Sunday, with the exception of exchange OKX.

What’s different about $BTC from yesterday is that net buying is maintained except for OKX. pic.twitter.com/x3Y1OegrsI

— CW (@CW8900) February 16, 2026

Bitcoin RSI teases “once per cycle lows”

Continuing on the wider status quo, Material Indicators cofounder Keith Alan stressed ongoing resemblances between this year and Bitcoin’s 2022 bear market.

Related: $75K or bearish ‘regime shift?’ Five things to know in Bitcoin this week

Relative strength index (RSI) readings on weekly time frames, he said, were pointing to a BTC price bottoming phase.

“Finding more similarities with 2022 in the $BTC chart as Weekly RSI moves towards what has historically been, once per cycle lows in oversold territory,” he told X followers.

“In 2015 and 2018 it marked bottom, however in 2022 it led to a 5 month consolidation before establishing a macro bottom.”

Weekly RSI measured 27.8 on Monday, marking the lowest reading since June 2022. Readings below 30 are considered “oversold.”

“This doesn’t mean it has to develop the same way this time, but it’s worth watching closely to identify similarities and deviations in the pattern to help with forecasting,” Alan added.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Read the full article here

Fact Checker

Verify the accuracy of this article using AI-powered analysis and real-time sources.