Listen to the article

BlackRock made its first formal move into decentralized finance this week, listing its tokenized Treasury fund on Uniswap, with Bitcoin and Ether staging only modest rebounds amid heavy ETF outflows.

Bitcoin (BTC) and Ether (ETH) each rose about 2.5% during the past week but were unable to cross key psychological levels due to mixed exchange-traded fund (ETF) flows and crypto investor sentiment sinking to record lows.

Bitcoin ETFs started the week with two consecutive days of inflows, but they quickly reversed with $276 million in outflows on Wednesday and $410 million on Thursday.

Ether ETFs saw similar flows, with two modest days of inflows, followed by $129 million in outflows on Wednesday and $113 million on Thursday, according to Farside Investors data.

In a silver lining to the correction, Bitcoin’s sharp drawdown to $59,930 may have marked a critical “halfway point” in the current bear market, as markets are now sitting at a critical inflection point that will determine the relevance of the four-year cycle theory, according to Kaiko Research.

Despite sliding crypto valuations, large institutions continue exploring cryptocurrency adoption, including the world’s largest asset manager, BlackRock, which announced its first foray into decentralized finance (DeFi) on Wednesday.

BlackRock enters DeFi, taps Uniswap for institutional token trading

Asset management giant BlackRock is making its first formal move into decentralized finance by bringing its tokenized US Treasury fund to Uniswap, marking a milestone moment for institutional adoption of DeFi.

According to a Wednesday announcement, BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) will be listed on the Uniswap decentralized exchange, allowing institutional investors to buy and sell the tokenized security.

As part of the arrangement, BlackRock is also purchasing an undisclosed amount of Uniswap’s native governance token, UNI, the announcement said.

The collaboration is being facilitated by tokenization company Securitize, which partnered with the world’s biggest asset manager on the launch of BUIDL.

According to Fortune, trading will initially be limited to a select group of eligible institutional investors and market makers before expanding more broadly.

“For the first time, institutions and whitelisted investors can access technology from a leader in the decentralized finance space to trade tokenized real-world assets like BUIDL with self-custody,” said Securitize CEO Carlos Domingo.

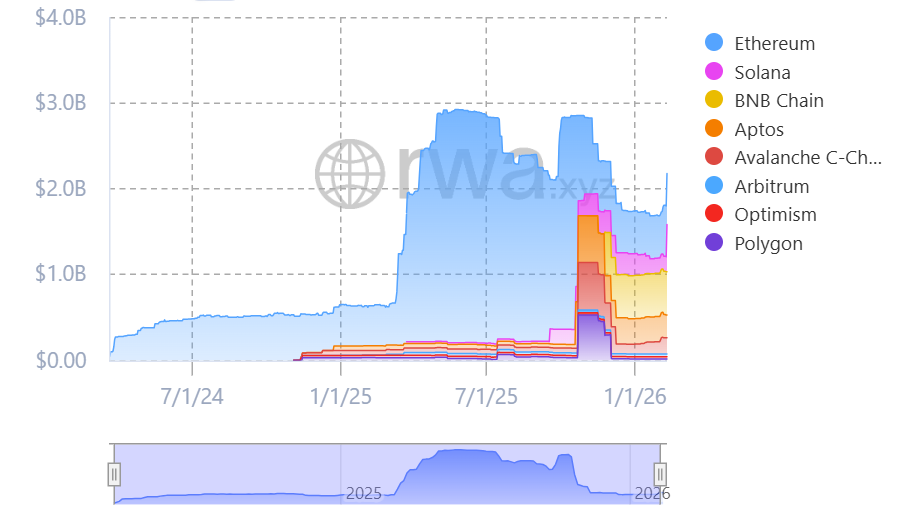

BUIDL is the biggest tokenized money market fund, with more than $2.18 billion in total assets, according to data compiled by RWA.xyz. The fund is issued across multiple blockchains, including Ethereum, Solana, BNB Chain, Aptos and Avalanche.

In December, BUIDL reached a key milestone, surpassing $100 million in cumulative distributions from its Treasury holdings.

Continue reading

Trump family’s WLFI plans FX and remittance platform: Report

World Liberty Financial (WLFI), a decentralized finance (DeFi) platform backed by the family of US President Donald Trump, announced on Thursday that it will launch foreign currency exchange (FX) and remittance services for its users.

The planned foreign exchange and remittance platform, called World Swap, seeks to challenge traditional remittance and FX service providers with lower fees and a simplified user interface, according to Reuters.

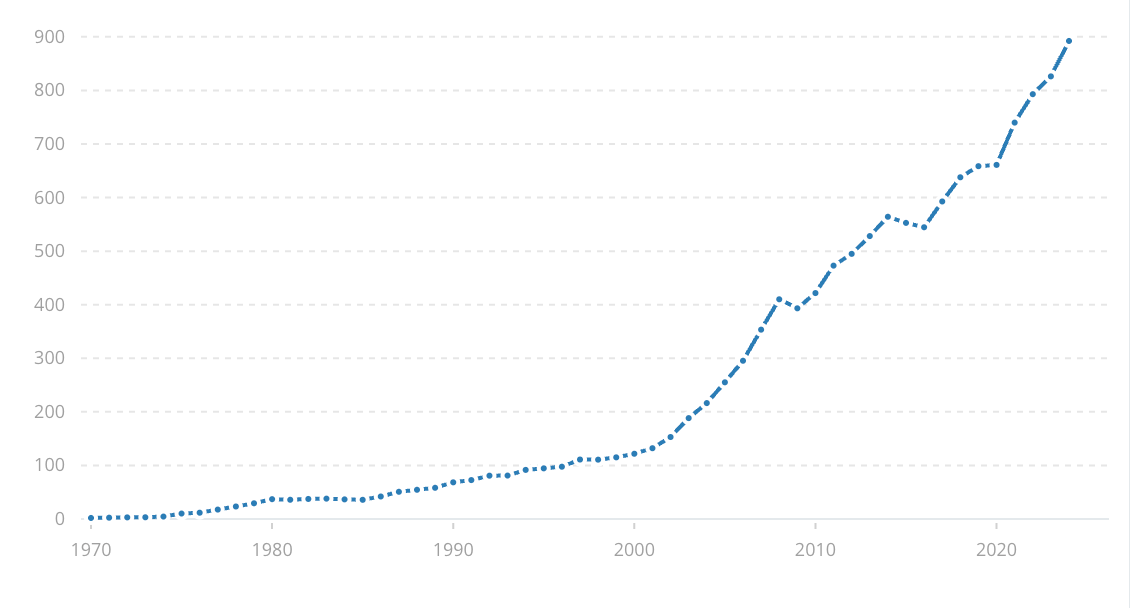

Daily global FX trading volume surpassed $9.6 trillion in April 2025, according to a report from the Bank for International Settlements (BIS), and the personal remittances market topped $892 billion in annual volume in 2024, according to data from the World Bank.

No exact timeline was given for the rollout. Cointelegraph reached out to World Liberty Financial but did not receive a response by the time of publication.

The expansion into FX and remittances follows WLFI’s application for a national trust bank charter in January and the launch of World Liberty Markets, a lending platform, as WLFI continues to grow while attracting scrutiny from Democratic lawmakers in the US.

Continue reading

Uniswap scores early win as US judge dismisses Bancor patent suit

A New York federal judge dismissed a patent infringement lawsuit brought by Bancor-affiliated entities against Uniswap, ruling that the asserted patents claim abstract ideas and are not eligible for protection under US patent law.

In a memorandum opinion and order on Tuesday, Judge John G. Koeltl of the US District Court for the Southern District of New York granted the defendant’s motion to dismiss the complaint filed by Bprotocol Foundation and LocalCoin Ltd. against Universal Navigation Inc. and the Uniswap Foundation.

The court found that the patents are directed to the abstract idea of calculating crypto exchange rates and therefore fail the two-step test for patent eligibility established by the US Supreme Court.

The ruling marks a procedural win for Uniswap, but it is not final. The case was dismissed without prejudice, giving the plaintiffs 21 days to file an amended complaint. If no amended complaint is filed, the dismissal will convert to one with prejudice.

Shortly after the ruling, Uniswap founder Hayden Adams wrote on X, “A lawyer just told me we won.”

“Uniswap Labs has always been proud to build in public — it’s a core value of DeFi,” a Uniswap Labs spokesperson told Cointelegraph. “We’re pleased that the court recognized that this lawsuit was meritless.”

Cointelegraph reached out to representatives of Bprotocol Foundation for comment but had not received a response by publication.

Continue reading

Binance completes $1 billion Bitcoin conversion for SAFU emergency fund

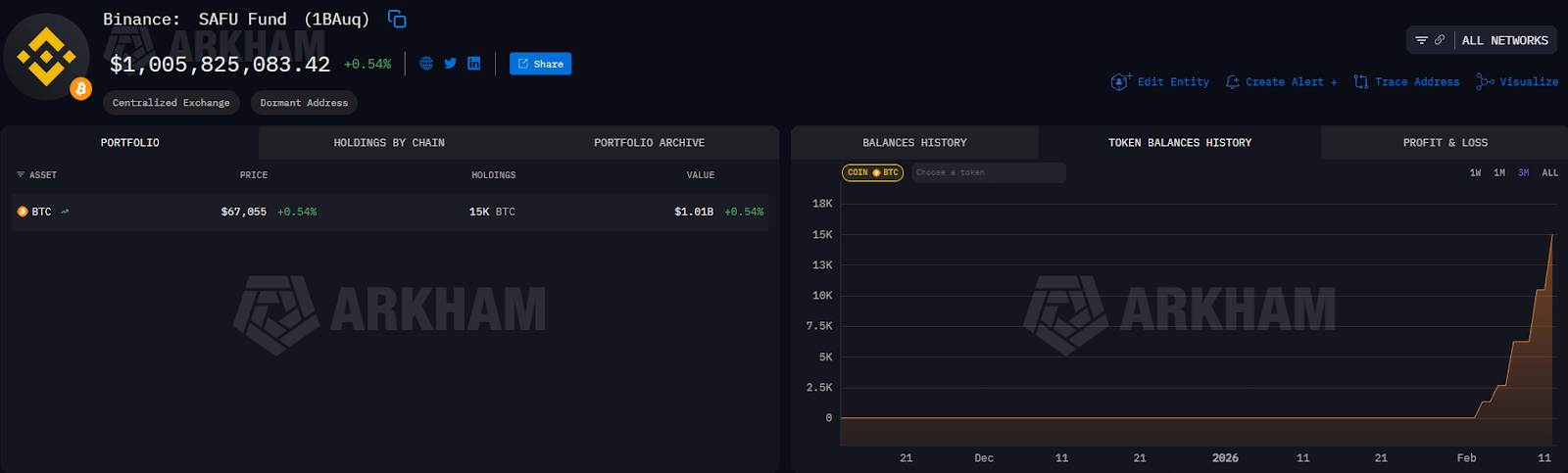

Binance completed the $1 billion Bitcoin conversion for its emergency fund, committing to holding Bitcoin as its core reserve asset.

Binance purchased another $304 million worth of Bitcoin (BTC) on Thursday, completing the conversion of $1 billion in Bitcoin for its Secure Asset Fund for Users (SAFU) wallet, according to Arkham data.

The fund now holds 15,000 Bitcoin, worth over $1 billion, acquired at an average aggregate cost basis of $67,000 per coin, Binance said in a Thursday X post.

“With SAFU Fund now fully in Bitcoin, we reinforce our belief in BTC as the premier long-term reserve asset.”

The last tranche of BTC came three days after Binance’s previous $300 million acquisition on Monday.

The exchange first announced it would convert its $1 billion user protection fund into Bitcoin on Jan. 30, initially pledging a 30-day window for the acquisitions, which were completed in less than two weeks.

The exchange said it would rebalance the fund if volatility pushes its value below $800 million.

Continue reading

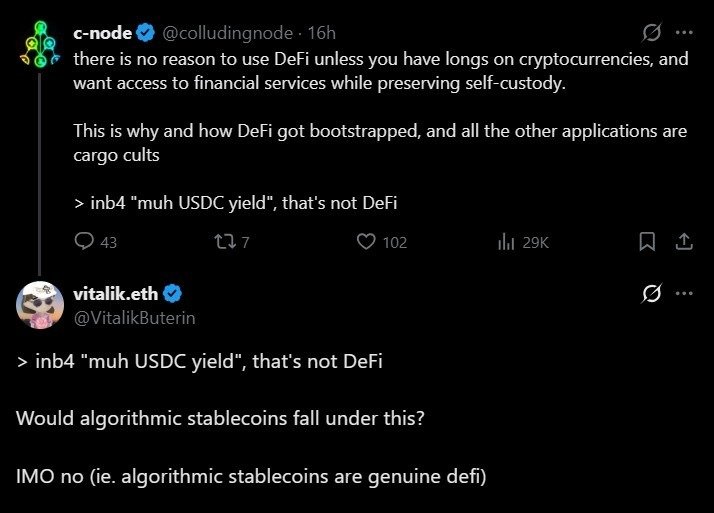

Vitalik draws line between “real DeFi” and centralized yield stablecoins

Ethereum co-founder Vitalik Buterin drew a clear boundary around what he considers “real” decentralized finance (DeFi), pushing back against yield-driven stablecoin strategies that he says fail to meaningfully transform risk.

In a discussion on X, Buterin said that DeFi derives its value from changing how risk is allocated and managed, not simply from generating yield on centralized assets.

Buterin’s comments come amid renewed scrutiny over DeFi’s dominant use cases, particularly in lending markets built around fiat-backed stablecoins like USDC (USDC).

While he did not name specific protocols, Buterin took aim at what he described as “USDC yield” products, saying they depend heavily on centralized issuers while offering little reduction in issuer or counterparty risk.

Continue reading

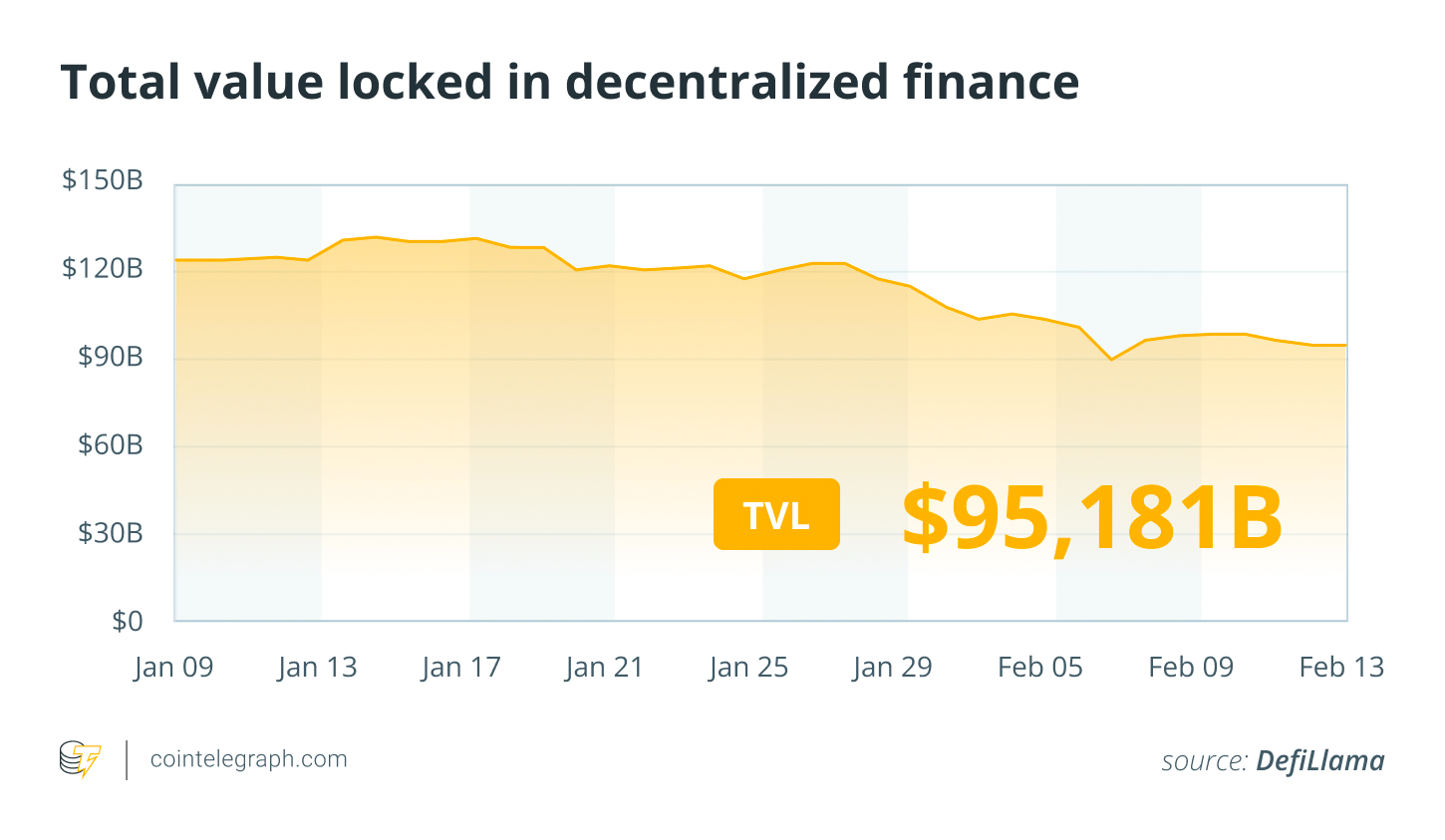

DeFi market overview

According to data from Cointelegraph Markets Pro and TradingView, most of the 100 largest cryptocurrencies by market capitalization ended the week in the green.

The Pippin (PIPPIN) token rose 195% as the week’s biggest gainer in the top 100, followed by the Humanity Protocol (H) token, up 57% during the past week.

Thanks for reading our summary of this week’s most impactful DeFi developments. Join us next Friday for more stories, insights and education regarding this dynamically advancing space.

Read the full article here

Fact Checker

Verify the accuracy of this article using AI-powered analysis and real-time sources.