Listen to the article

Bank Negara Malaysia (BNM), the country’s central bank, said on Wednesday that its Digital Asset Innovation Hub (DAIH) is piloting three regulatory sandbox programs to research and develop stablecoins and tokenized bank deposits.

BNM’s initiatives center around using ringgit stablecoins, the fiat currency of Malaysia, for cross-border settlement and developing tokenized real-world assets (RWAs), according to the announcement.

The pilot also aims to test tokenized bank deposits, with all research potentially applicable to the development of a wholesale central bank digital currency (CBDC), onchain fiat currency issued and managed directly by a central bank.

Partners for the trials include banking institutions Standard Chartered Bank, CIMB Group Holding, Maybank, and investment holding company Capital A.

Malaysia’s central bank will also assess “Shariah-related considerations,” which refers to the Islamic code of law governing social, financial and political customs.

The pilot programs will “inform our policy direction in these specified areas,” according to the BNM statement, highlighting the global race among nation-states to tokenize assets, including fiat currencies, for use in the digital economy.

Related: China bans stablecoin and RWA issuance by foreign and domestic companies

Roadmap to expand digital asset footprint

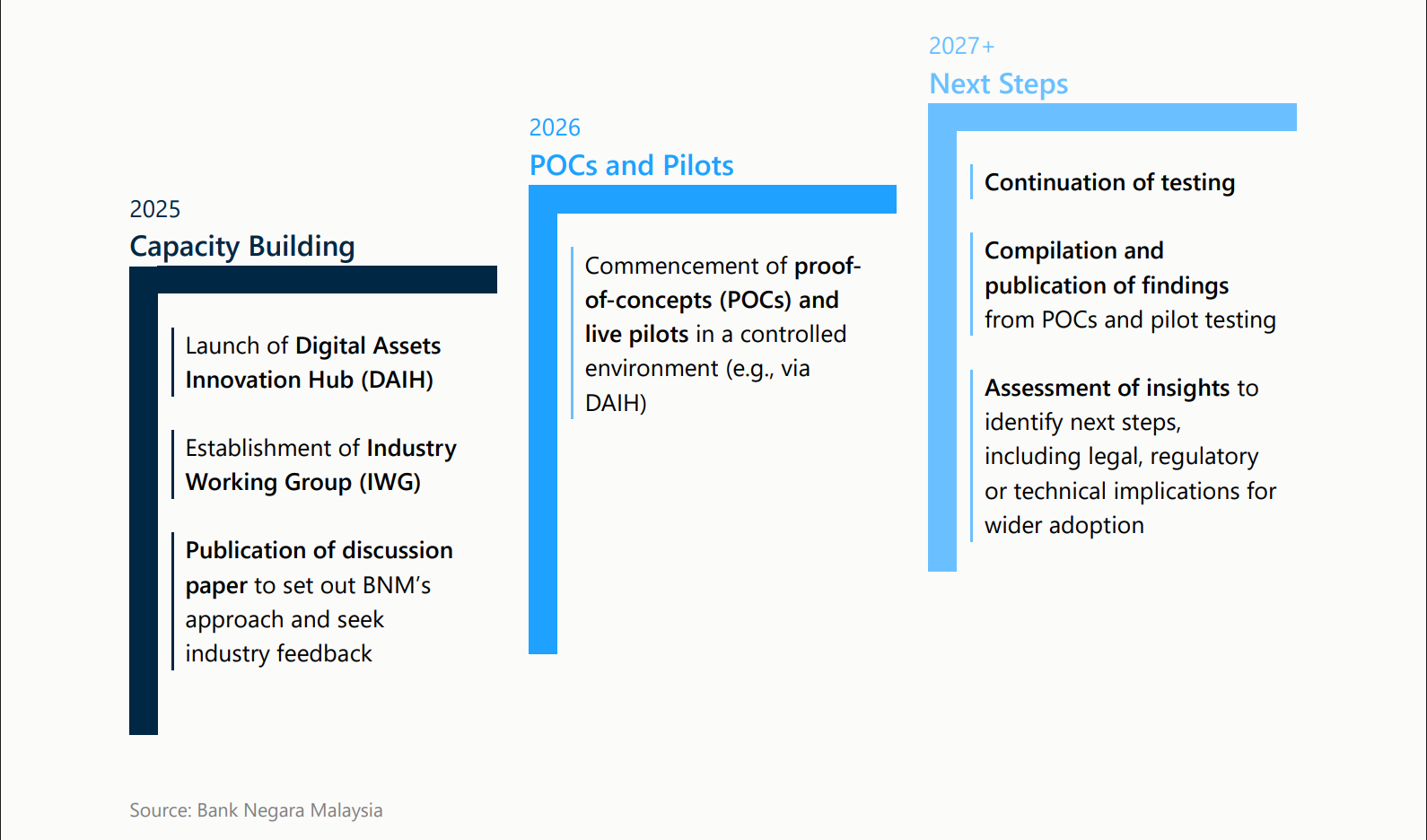

In November 2025, officials in Kuala Lumpur published a three-year roadmap to test asset tokenization across several real-world sectors.

These real-world use cases included supply chain management, Shariah-compliant financial products, access to credit, programmable finance and 24/7 cross-border settlement, according to a BNM discussion paper.

Ismail Ibrahim, the crown prince of Malaysia, launched a ringgit-pegged stablecoin in December under the ticker symbol RMJDT.

The stablecoin was issued by Bullish Aim, a telecom company owned by Ibrahim, but is still in the regulatory sandbox testing phase and not yet open to public trading.

That same month, Standard Chartered Bank and Capital A also announced plans to explore a ringgit-pegged stablecoin for wholesale settlement.

Wholesale stablecoins and CBDCs are meant for institutional settlement between authorized parties such as nation-states or central banks and are not intended for retail use.

Magazine: Bitcoin vs stablecoins showdown looms as GENIUS Act nears

Read the full article here

Fact Checker

Verify the accuracy of this article using AI-powered analysis and real-time sources.