Listen to the article

Key takeaways:

-

Bitcoin options show the highest level of fear in a year, as traders brace for the possibility of a deeper selloff.

-

Bitcoin markets might be more stable due to high-risk leveraged positions being liquidated.

Bitcoin (BTC) underwent a sharp 10% correction between Wednesday and Thursday, retesting the $81,000 level for the first time in over two months. The move occurred as traders grew increasingly cautious following significant outflows from spot Bitcoin exchange-traded funds (ETFs), particularly as gold prices dropped 13% from their Wednesday all-time high.

The strong price changes caused traders to question the strength of the $80,000 psychological support level.

US-listed spot Bitcoin ETFs have seen $2.7 billion in net outflows since Jan. 16, representing 2.3% of total assets under management. Some market participants worry that institutional demand has stalled, while others note that gold’s 18% gain over three months may be temporarily overshadowing Bitcoin’s appeal as a store of value. Regardless of the specific catalyst for the decline, the perception of risk in the market has clearly risen.

Quantum computing threat adds to Bitcoin investor anxiety

One primary source of anxiety is the potential threat posed by quantum computing to the cryptographic methods securing blockchains. Coinbase recently formed an independent advisory board to evaluate these risks, with plans to release public research by early 2027. This initiative will operate separately from the company’s core management.

The debate intensified after Jefferies removed Bitcoin from its flagship portfolio, citing these long-term security concerns. However, cryptographer and Blockstream co-founder, Adam Back, predicted that there would be no material quantum risk over the next decade. Back argued that the technology remains at a very early stage, and even partial breaks in cryptography would not allow Bitcoin to be stolen.

Related: Bitcoin futures imbalance may spark liquidation revenge rally to $90K

Bitcoin options turn bearish

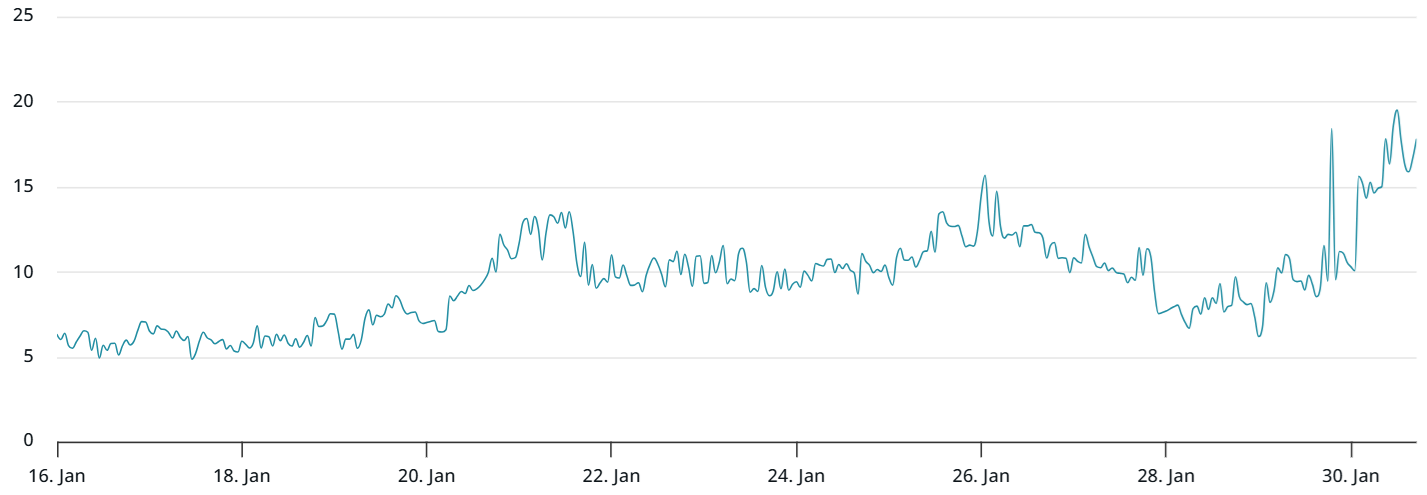

The BTC options delta skew surged to 17% on Friday, reaching its highest point in over a year. In neutral market conditions, put (sell) options typically trade at a premium of 6% or less compared to equivalent call (buy) instruments. Current levels indicate extreme fear, which often leads to volatile price swings as market makers hedge against further downside.

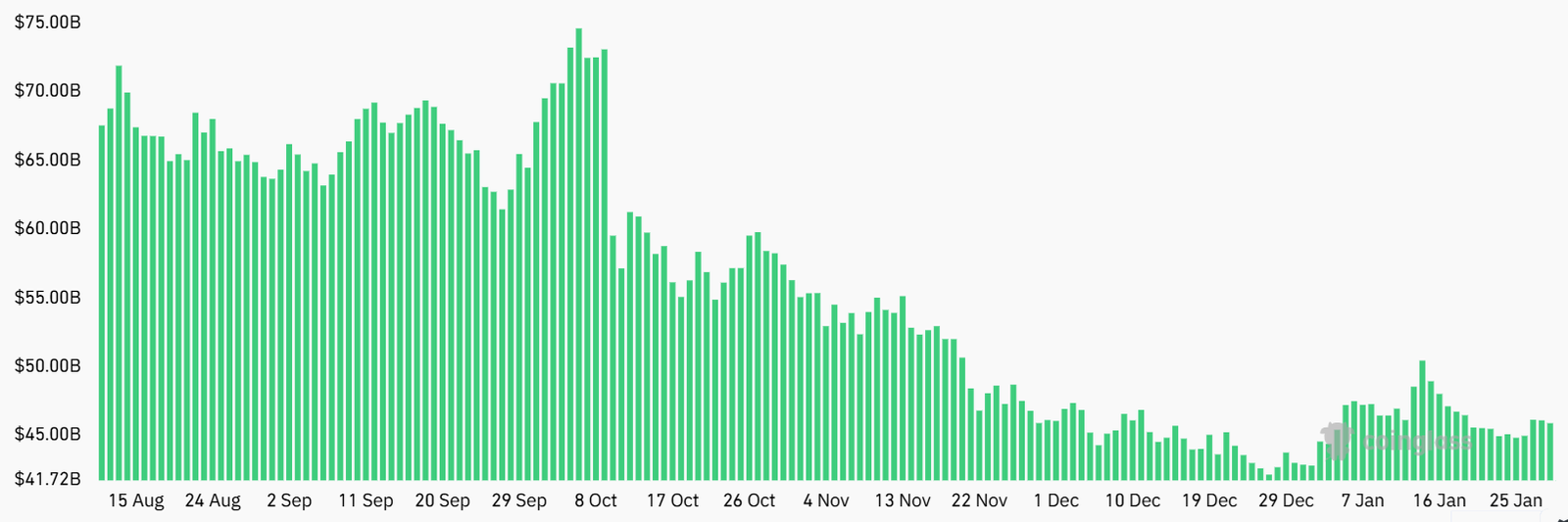

Approximately $860 million in leveraged long BTC futures positions were liquidated between Thursday and Friday, suggesting many traders were caught off guard. However, it might be inaccurate to blame the crash entirely on leverage; aggregate BTC futures open interest actually fell to $46 billion on Thursday, down from $58 billion three months ago.

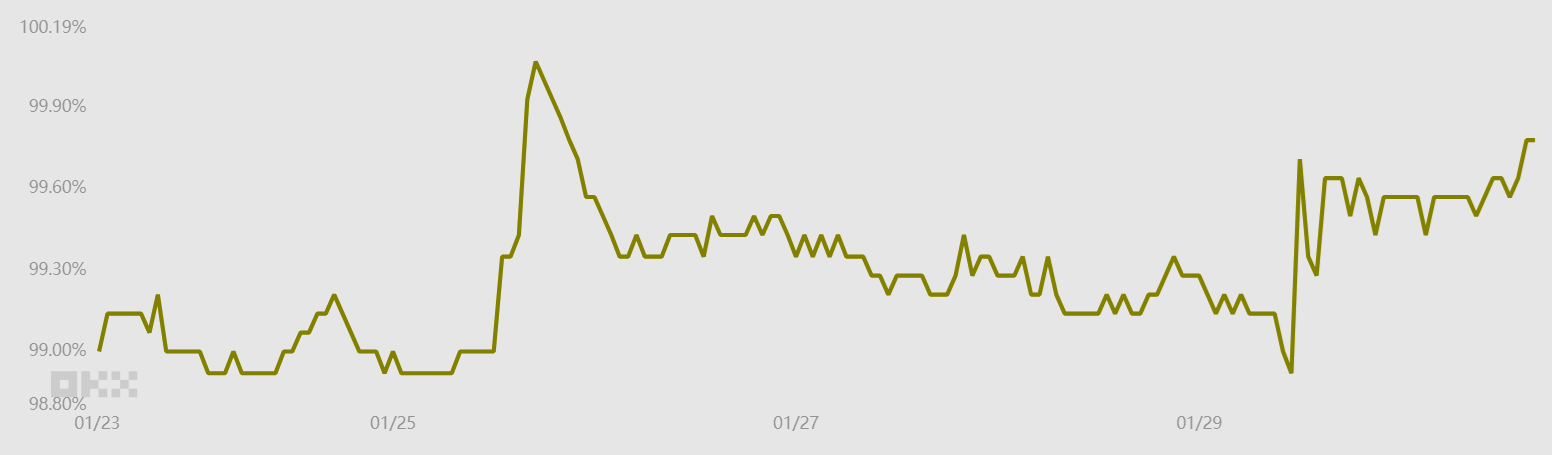

Declining interest in leveraged futures is not always a bearish signal. The market is now healthier because excessive leverage has been purged. To better gauge risk appetite, analysts often look at stablecoin demand in China. When investors rush to exit the crypto market, this indicator usually drops below parity.

Typically, stablecoins trade at a 0.5% to 1% premium relative to the US dollar/Yuan exchange rate. The current 0.2% discount suggests moderate outflows, though this is a slight improvement from the 1% discount seen last week. Ultimately, Bitcoin derivatives reflect a cautious mood following a 13% price drop during the last 14 days.

Whether Bitcoin can reclaim $87,000 and regain bullish momentum likely depends on investors realizing that no asset is immune to corrections when macroeconomic and socio-political concerns drive a sudden surge in demand for cash and short-term US Treasuries.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.

Read the full article here

Fact Checker

Verify the accuracy of this article using AI-powered analysis and real-time sources.